I have many farmers here that want to talk about the peanut market when they call or visit for pod blasting, as if it is something that is within our control. Most area farmers took substantial risk this year planting a crop without any contract, and they are looking for any help they can get to make marketing decisions. I’m no economist, but I try to keep up with the various USDA and NASS reports and keep an “inhouse” spreadsheet of production and usage. Here are a few thoughts on supply, demand, and carryover using the current “expectations.”

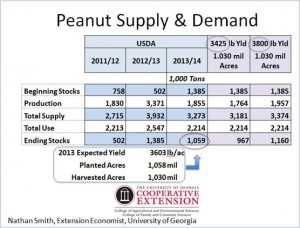

Dr. Nathan Smith, University of Georgia Extension Ag Economist, recently provided some graphics that help show the situation clearly. We start with the carryover on July 31, 2013 of 1.385 million tons (12/13 column). We know the market is comfortable at 600-800k tons. We also know harvested acres will be about 1.03 million unless there is more abandonment than expected. USDA is estimating national average yield at 3,603 lbs/acre. When we plug in 3,603 lbs on 1.03 million acres we show a carryover of 1,059,000 tons which is very large. It appears to me in my record sheets that USDA reduced demand in the 12/13 marketing year by 76,000 tons and 60,000 tons in the 13/14 marketing year compared to their previous estimates. Perhaps we aren’t using as many peanuts as the trade hoped. We also had a report that NASS increased certified planted acreage by about 30,000 acres two weeks ago. So the latest news appears to show increases in supplies and reduction in demand compared to previous reports.

Dr. Nathan Smith, University of Georgia Extension Ag Economist, recently provided some graphics that help show the situation clearly. We start with the carryover on July 31, 2013 of 1.385 million tons (12/13 column). We know the market is comfortable at 600-800k tons. We also know harvested acres will be about 1.03 million unless there is more abandonment than expected. USDA is estimating national average yield at 3,603 lbs/acre. When we plug in 3,603 lbs on 1.03 million acres we show a carryover of 1,059,000 tons which is very large. It appears to me in my record sheets that USDA reduced demand in the 12/13 marketing year by 76,000 tons and 60,000 tons in the 13/14 marketing year compared to their previous estimates. Perhaps we aren’t using as many peanuts as the trade hoped. We also had a report that NASS increased certified planted acreage by about 30,000 acres two weeks ago. So the latest news appears to show increases in supplies and reduction in demand compared to previous reports.

Dr. Smith included an additional column in his table for sake of discussion. This column shows what if average yield is overestimated and average yield is 3425 lbs/acre? We would still have a very large carryout of 967,000 tons. Some of us were thinking that carryouts would be lower than these levels, but as demand and demand expectations continue to be lowered, inventory grows.

Looking for years that show a similar high carryout level, my records show a carryout of 918,000 tons prior to planting the 2009 crop. My numbers show contract offers of $375 per ton in 2009. Corn could be contracted in February 2009 for$4.25/bu for Dec delivery, slightly less than what is available for Dec 14. Cotton could be forward contracted for 0.52/lb and beans for $9.50/bu. Some will say that is irrelevant, because we had offers for $450/ton this spring with a 1.3m ton carryover. However, I believe that offer was a limited effort to compete for acres with $7 corn and $0.90 cotton. We don’t have those pricing opportunities for 2014 at this time. My expectation is winter contract offers will look much like last winter/spring with a minimal effort to gather planted acreage above 1 million.

Our area of North Florida has by far the best crop I have seen since beginning employment in North Florida in 2006. I went along on the Georgia Peanut Tour (GPT) and we saw digging and picking going on, and peanuts in South Georgia looked pretty good. Some of the discussion on the GPT was that the market needs to continue to balance out the acres and production. My concern is it appears that many peanut farmers will need to operate below their break-even in this newly “balanced” market. Personally, I think the market wants to “balance” on $475/ton peanuts, and many farmers have breakeven costs above this level. High yields reduce some of these concerns, but I don’t personally feel comfortable budgeting on 4,200 average production in order to project a profit when we sit down for planning in December and January. If the bankers are OK with it, I guess we roll the dice another year for lack of better options. (Sorry, I use “we” loosely. But “we” are all in this together).

Here is a glance at what peanuts in our area look like upside down. It is exciting, but hard to be bullish prices when seeing nuts like this in our area. In many ways, our area had the “perfect storm” of excellent crop conditions much like Georgia and Alabama experienced in 2012. I suspect most of the “fringe” areas which missed the heavy rainfall events will have comparable high yields.