Most of our local farmers are getting back to the business of planning their crop rotations and budgeting for 2014. We are starting to hear chatter about the Peanut Market and contracting opportunities. This is an important time for farmer planning so they have as much information available as possible. Mr. Jim Moore of JRJ Brokerage Co., Inc. recently shared his observations from within the industry. When we spoke he a had a few comments that were in-line with my local observations/expectations which I will also address. Mr. Moore provided the following bullet list. Some discussion notes follow each bullet in parentheses.

-

2013 crop larger than most expected. “The Fed-State Inspection Service is reporting 2.05 million tons graded, from an average yield of about 3,994 pounds per acre.”

-

Estimated 2013 crop carryout as of October 2014 = 750,000 Farmer Stock Tons. “October 2014 carryout is the representative of what many of us call the ‘pipeline’ number. Mr. Moore suggests 350,000 tons would be a more healthy balance between supply and demand.”

-

Peanut exports expected to be back to normal following China’s quick entry and exit from the U.S. market.

-

Shelled market trading lower the last 3-4 weeks. “Latest reports are shelled peanuts trading at 0.50 per pound. Buyers appear to be waiting for historically low prices in the mid 0.40’s to make large purchases.”

-

Early farmer contracting for 2014 crop not expected. “Shellers and buyers haven’t really threshed out the ‘value’ of peanuts given the large carryout.”

-

Rally in competing commodities (corn/cotton) not likely. “Many acres in the Southeast that were planted to corn in 2013 will be looking for rotation crops. Expecting planted acreage of 1.2-1.25 million acres.”

-

Consumption good across 3 major edible peanut product categories, all 3 categories promoting products. “Good news. The crop is excellent quality at attractive prices.”

When looking at the overall situation. There are several important questions from my perspective. 1. What are the “value” of peanuts by the ton? 2. How many acres will be planted? 3. What does carryout look like if we achieve average yield levels?

1. I usually use the following procedure to estmate the “value” of a ton of peanuts. Assuming 1400 pounds of shelled peanuts per ton. Current price of shelled peanuts 0.50 per lb = a value of $700 per ton. Long-term, it looks to me that the shellers like to earn about $300 for their shelling/handling/marketing/risk. That puts “Mace Bauer’s” estimate of the value of peanuts around $400 per ton. Mr. Moore reported his contacts in the industry, the buyers, are expecting prices to fall, and are therefore holding back from purchasing at this time.

2. Peanut planted acreage is a rather small mix of the cropland in the United States. Therefore, we have seen in the last several years that shifts of only 200,000 acres the wrong way can greatly upset market dynamics. Working with farmers here locally, I fully expect we will overplant peanuts compared to the market need. There are many large farmers in this area who will not plant corn at these price levels, they cannot make cotton work on paper at the available price, and peanuts are “old reliable” with two years of very high yields in the rearview mirror. If the plantings are around 1.2 million acres as some suggest we can begin to plug in some production estimates for 2014.

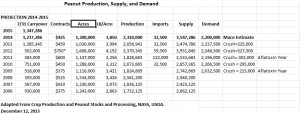

3. The large acreage reduction of 2013 resulted in reducing peanut supply levels only slightly. We know that dry weather is always a potential yield reducer, but we have to plan for the “average” year, and that is a year of 50-55″ of rain in the Southeast, mostly falling in June, July, and August. Other regions typically have reasonable weather patterns resulting in high yield as well. Planting the current cultivars, yields of 3,850 pounds appears to be a reasonable, conservative expectation. Higher yields, similar to those of the last two years should bring carryout above the record levels of 2012-13. The table below are my own current expectations. As the season progresses and more information becomes available we can tweak the numbers. However, my initial thoughts are we grow the carryout to 2012-2013 levels. I suspect others in the industry are not far from these numbers, and thus the “chill” over the industry right now.