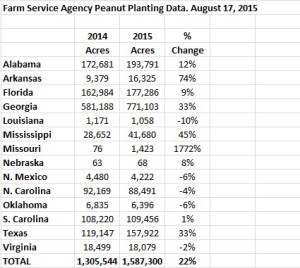

Much like one of my favorite songs, it looks like we “blew the doors off” the peanut market this year. Farm Service Agency has released the planted acres summary, and there aren’t any positive surprises, from a peanut pricing standpoint. I also suspect the old saying “Big Crops Get Bigger” is in order as well. The USDA National Ag Statistics Survey is currently projecting a national yield of 3,950 pounds per acre. If this comes to fruition, this would be lower than the average yield of each year from 2012-2014. Planted acres are up 22% nationally compared to 2014. There were big increases in several states including Alabama, Florida, Georgia, Mississippi, and Texas. As always, actual yield in Georgia will be a dominant factor in market prices for farmer-stock peanuts moving ahead, as that will be about half of the entire national crop.

Much like one of my favorite songs, it looks like we “blew the doors off” the peanut market this year. Farm Service Agency has released the planted acres summary, and there aren’t any positive surprises, from a peanut pricing standpoint. I also suspect the old saying “Big Crops Get Bigger” is in order as well. The USDA National Ag Statistics Survey is currently projecting a national yield of 3,950 pounds per acre. If this comes to fruition, this would be lower than the average yield of each year from 2012-2014. Planted acres are up 22% nationally compared to 2014. There were big increases in several states including Alabama, Florida, Georgia, Mississippi, and Texas. As always, actual yield in Georgia will be a dominant factor in market prices for farmer-stock peanuts moving ahead, as that will be about half of the entire national crop.

There has been some chatter among the “farmer hotline” about the USDA lowering the “Loan Rate” of peanuts. Farmers utilize the “loan” as a minimum price they receive, roughly $355/ton. So far, I have found no information indicating a potentially reduced loan rate during the term of this Farm Bill. However, the USDA has temporarily altered the “Loan Repayment Rate,” which is something that has occurred in each of the past several years to move more peanuts from the loan and into the shellers’ possession. It may have other implications as a “marketing loan gain,” but is not the same as reducing the loan rate. Concerned farmers are probably confusing these two actions. I will gather more specific information on those potential impacts as they are determined, but there is no current discussion of reducing the loan rate, that I have found.

The table below includes an ongoing summary of the USDA Peanut Stocks and Processing Report. It is obvious in this chart that the carryout will grow beyond any level since the “modern era” when the quota program was lifted. Weather at harvest could still be impactful on final yields, but this crop has seen overall good conditions with few problems reported so far.

The table below includes an ongoing summary of the USDA Peanut Stocks and Processing Report. It is obvious in this chart that the carryout will grow beyond any level since the “modern era” when the quota program was lifted. Weather at harvest could still be impactful on final yields, but this crop has seen overall good conditions with few problems reported so far.